/wp-content/uploads/Partnership-Model-2025-2026.pdf

RFID Security Tag Pickup Schedule – Campus Access Upgrade

As part of our ongoing commitment to enhancing campus security, safety, and convenience, we are introducing RFID gate access tags for all staff and congregants. These tags will be installed on your vehicle, allowing you to enter through the parking lot gates automatically.

🔐 What is an RFID Tag?

An RFID tag is a small sticker that enables automatic access through our security gates when driving onto campus. It will be installed on your vehicle’s front passenger-side headlight. Once installed, the front parking lot gate will automatically open as your vehicle approaches.

🛠️ Installation Process

To ensure a smooth distribution process, RFID tag installation times have been scheduled by last name. 📍 Installation will take place in the back of the parking lot and should take no more than five minutes, depending on traffic.

📋 What to Bring

Please bring the following to your installation appointment:

- One fully completed RFID application per vehicle

- The vehicle receiving the tag

- Photo ID to verify your identity. This helps us ensure accurate distribution and maintain the security of our campus access system.

🚗 Pickup Schedule

Last name begins with A–E

Monday, April 28 – 9:00 – 11:00 AM

Last name begins with F–K

Tuesday, April 29 – 9:00 – 11:00 AM or 4:00 – 6:00 PM

Last name begins with L–O

Wednesday, April 30 – 9:00 -11:00 AM or 4:00 – 6:00 PM

Last name begins with P–S

Thursday, May 1 – 9:00-11:00 AM

Last name begins with T–Z

Friday, May 2 – 9:00-11:00 AM

If you are unable to make your scheduled time, please reach out to us to coordinate an alternative pickup.

Thank you for your support in helping us create a safe and welcoming campus environment. Download the RFID Application Here

TAE Create Laughter Auction Items

🎉 Help Us Make TAE Creates Laughter a Night to Remember! 🎭

Temple Adat Elohim’s biggest fundraiser of the year, TAE Creates Laughter, is happening on June 7, 2025, and we need your support to make it a success!

This year, we are striving to raise funds to cover the cost of our ECC playground safety upgrade. This essential upgrade will create a safe, modern, and enriching environment where young children can learn, grow, and thrive.

The new playground will: ✔ Meet modern safety and ADA compliance standards ✔ Use non-toxic, impact-resistant, and weather-resistant materials ✔ Promote physical activity, motor skill development, social interaction, teamwork, and creative play

We are currently collecting donations for our silent and live auctions, and we’re looking for a wide variety of items that will appeal to all ages and interests. Whether you’re able to give something big or small, every donation makes a difference and helps us create an exciting, engaging, and fun evening for our community

Suggested Auction Donations Include:

🛍️ Gift cards to local businesses or restaurants

🍷 Wine or curated wine baskets

🏖️ Vacation homes, time shares, or weekend getaways

🎟️ Sports and concert tickets

💆♀️ Spa treatments, massages, or wellness services

🏋️♀️ Fitness classes or gym memberships

🎨 Art pieces or handmade goods

🍽️ Private chef dinners or cooking classes

🧺 Themed gift baskets

✨ Unique experiences or behind-the-scenes tours

Be creative! We’re building an auction with items at all price points so there’s something fun for everyone to bid on.

👉 To donate an item or ask questions, please contact Joni Berger at (805) 377-3576.

Let’s come together, give generously, and make this our best event yet! 🙌💖

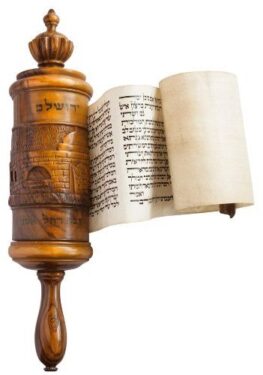

Purim – Book of Esther (9:22)

“As the days wherein the Jews had rest from their enemies, and the month which was turned unto them from sorrow to gladness, and from mourning into a good day; that they should make them days of feasting and gladness, and of sending portions one to another, and gifts to the poor.” (Translation – JPS 1917)

“As the days wherein the Jews had rest from their enemies, and the month which was turned unto them from sorrow to gladness, and from mourning into a good day; that they should make them days of feasting and gladness, and of sending portions one to another, and gifts to the poor.” (Translation – JPS 1917)

This verse establishes the key traditions of Purim: celebrating with feasting, joy, sharing food (mishloach manot), and giving charity (matanot la’evyonim). It reflects the transformation from danger to deliverance, which is the essence of Purim.